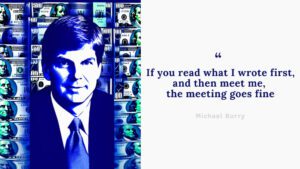

MICHAEL BURRY - BEST QUOTES

I try to buy shares of unpopular companies when they look like road kill and sell them when they’ve been polished up a bit

Lost dollars are simply harder to replace than gained dollars are to lose

What you want to watch are the lenders, not the borrowers. The borrowers will always be willing to take a great deal for themselves. It’s up to the lenders to show restraint, and when they lose it, watch out

I started trading stocks, options and futures while I was at UCLA, using my earnings from working summers at the old IBM plant on Cottle Road. I never lost interest in how companies work. It’s fundamental to who I am

As my moniker implies, I’m a value investor. A pretty deep one. Yet while my influences are traditional, I’ve developed my own version of value investing. This version has been tuned empirically with a singular goal: maximize risk-adjusted returns

I seek individual investments that will allow me to target total portfolio returns of at least 20% annually after fees and expenses on an annual basis over a period of years, not months

2000, 2008, 2023, it is always the same. People full of hubris and greed take stupid risks, and fail. Money is then printed. Because it works so well.

Back in 2005 and 2006, I argued as forcefully as I could, in letters to clients of my investment firm, ‘Scion Capital’, that the mortgage market would melt down in the second half of 2007, causing substantial damage to the economy

At one point I recognized that Warren Buffett, though he had every advantage in learning from Ben Graham, did not copy Ben Graham, but rather set out on his own path, and ran money his way, by his own rules. . . .

My natural state is an outsider, and no matter what group I’m in or where I am, I’ve always felt like I’m outside the group, and I’ve always been analyzing the group

I will always choose the dollar bill carrying a wildly fluctuating discount rather than the dollar bill selling for a quite stable premium

Common hedging techniques include shorting stocks, buying put options, writing call options, and various types of leverage and paired transactions. While I do reserve the right to use these tools if and when appropriate, my firm opinion is that the best hedge is buying an appropriately safe and cheap stock

I am a firm believer that it is a dog eat dog world out there. And while I do not acknowledge market efficiency, I do not believe the market is perfectly inefficient either

My weapon of choice as a stock picker is research; it’s critical for me to understand a company’s value before laying down a dime

Innovation, especially in America, is continuing at a breakneck pace, even in areas facing substantial political or regulatory headwinds. The advances in health care in particular are breathtaking – so many selfless souls are working to advance science, and this is heartening

The late 90s almost forced me to identify myself as a value investor, because I thought what everybody else was doing was insane

The major reform legislation, Dodd-Frank, was named after two guys bought and sold by special interests, and one of them should be shouldering a good amount of blame for the crisis

‘Ick investing’ means taking a special analytical interest in stocks that inspire a first reaction of ‘ick.’ I tend to become interested in stocks that by their very names or circumstances inspire unwillingness – and an ‘ick’ accompanied by a wrinkle of the nose on the part of most investors to delve any further

My positioning with my investors was always, I need three to five years

Regardless of what the future holds, intelligent investment in common stocks offer a solid route for a reasonable return on investment going forward

I don’t believe anything unless I understand it inside out. And even if I understand something, it is not uncommon that I disagree with accepted view

My nature is not to have friends. I’m happy in my own head.

Time is a variable continuum: An afternoon can fly by or it can take 5 hours.

In essence, the stock market represents three separate categories of business.They are, adjusted for inflation, those with shrinking intrinsic value, those with approximately stable intrinsic value, and those with steadily growing intrinsic value

I think a lot of hedge funds get their trades from Wall Street and get their ideas from Wall Street. And I just like to find my own ideas. I’m reading a lot; I read a lot of news. I’m addicted to it. I basically – I follow my nose on news stories

A portfolio manager must understand that safeguarding against loss does not end with finding the perfect security at the perfect price. If it did, then the perfect portfolio would likely consist of one security

Successful portfolio management transcends stock picking and requires the answer to several essential questions:

What is the optimum number of stocks to hold? When to buy? When to sell?

One of the risks for anybody in the lending business is that being conservative can harm your competitiveness

In my view, men are at their

best when scrambling from the abyss, and are typically something less at all

other times

It is a tenet of my investment style that, on the subject of common stock investment, maximizing the upside means first and foremost minimizing the downside. The deleterious effect of permanent capital loss on portfolio returns cannot be overstated

Fresh, clean water cannot be taken for granted. And it is not – water is political, and litigious. Transporting water is impractical for both political and physical reasons, so buying up water rights did not make a lot of sense to me, unless I was pursuing a greater fool theory of investment – which was not my intention

Sources:

EXCERPT APRIL 2010 ISSUE/ Betting on the Blind Side / BY MICHAEL LEWIS /

OP-ED CONTRIBUTOR / I Saw the Crisis Coming. Why Didn’t the Fed? /By Michael J. Burry/

https://www.youtube.com/watch?v=RnRGp2Ejcso

Lewis, M. (2011). The big short: inside the doomsday machine. New York, W.W. Norton.

https://news.vanderbilt.edu/2011/04/13/michael-burry-transcript/