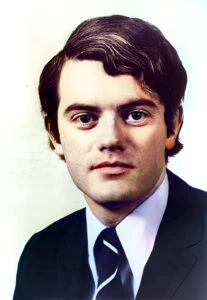

PETER LYNCH

Key Takeaways from Peter Lynch's Life and Career

Key Takeaways

- Early Life & Education: Born in 1944, Lynch experienced financial hardship early on, losing his father at age 10. He worked as a caddie to support his family and went on to study history, psychology, and philosophy at Boston College, followed by an MBA at the Wharton School.

- Investment Career: Lynch began his career at Fidelity Investments in 1966 and managed the Magellan Fund from 1977 to 1990, achieving an average annual return of 29.2% and growing the fund’s assets from $18 million to $14 billion.

- Investment Philosophy: He popularized principles like “invest in what you know” and “ten bagger,” focusing on individual company analysis and avoiding market timing.

- Writing & Legacy: Lynch authored several influential investment books, including One Up on Wall Street and Beating the Street. His legacy includes the GARP (Growth At a Reasonable Price) investment strategy.

- Philanthropy: After retiring, Lynch became heavily involved in philanthropy, establishing the Lynch Foundation and supporting educational, cultural, and medical initiatives.

Who is Peter Lynch ?

Early Life & Education (1944-1968)

- 1944: Peter Lynch is born on January 19 in Newton, Massachusetts.

- 1951-1954: Lynch’s father is diagnosed with brain cancer and passes away three years later. Lynch begins working as a caddie to support his family.

- 1965: Graduates from Boston College, majoring in history, psychology, and philosophy.

- 1968: Earns an MBA from the Wharton School of the University of Pennsylvania.

Early Career at Fidelity (1966-1977)

- 1966: Lynch joins Fidelity Investments as an intern, initially covering industries like paper, chemicals, and publishing.

- 1969: After serving two years in the Army, Lynch is hired permanently at Fidelity, where he expands his coverage to include textiles, metals, mining, and chemicals.

- 1974-1977: Becomes Fidelity’s Director of Research, focusing on identifying investment opportunities across a range of industries.

Managing the Magellan Fund (1977-1990)

- 1977: Lynch is named head of the Magellan Fund, then worth $18 million.

- 1977-1990: Under his leadership, the Magellan Fund becomes the best-performing mutual fund globally, averaging a 29.2% annual return and growing its assets to over $14 billion with over 1,000 stock positions.

- Lynch’s investment strategy emphasizes individual company fundamentals, with successful investments in stocks like Fannie Mae, Ford, Philip Morris, and Dunkin’ Donuts.

- 1990: Lynch retires as Magellan Fund manager but remains involved with Fidelity as Vice Chairman of Fidelity Management & Research Co.

Investment Philosophy & Writings (1989-1992)

- 1989: Publishes One Up on Wall Street, which outlines his investment philosophy and becomes a bestseller with over one million copies sold.

- 1992: Publishes Beating the Street, offering practical insights on stock picking and expanding on concepts introduced in his earlier book.

- Lynch coins several phrases, including “invest in what you know,” encouraging investors to leverage personal knowledge in their investments, and “ten bagger,” referring to investments that grow tenfold in value.

- Introduces and popularizes the “GARP” (Growth At a Reasonable Price) investment strategy, which balances growth potential with valuation discipline.

Philanthropy & Later Years (1991-Present)

- 1991: Lynch is inducted into the Junior Achievement U.S. Business Hall of Fame.

- 2006: Listed among the top 50 wealthiest Bostonians by Boston Magazine with a net worth of $352 million.

- Establishes the Lynch Foundation, which focuses on educational, cultural, religious, and medical causes. Lynch views philanthropy as an “investment” in ideas that can spread and make an impact.

- 2010: Donates $20 million to establish the Lynch Leadership Academy for training school principals.

- Makes significant contributions to Boston College, resulting in the naming of the Lynch School of Education and Human Development.

- Continues to work part-time at Fidelity, mentoring young analysts while remaining actively involved in philanthropic work.

- 1992: Receives the Seton Award from the National Catholic Education Association.

- Serves on the Harvard Medical School Board of Fellows, contributing to medical education and research.

Personal Life

- Married Carolyn Ann Hoff, with whom he had three daughters. Carolyn passed away in 2015 due to leukemia.

- Lynch’s passion for philanthropy is closely tied to his family values, with the Lynch Foundation playing a significant role in supporting various causes throughout Boston and beyond.

Net Worth

- Peter Lynch’s net worth is estimated at $ 450 million. In 2006, according to Boston Magazine Lynch’s net worth was $ 352 million.

GARP (Growth At a Reasonable Price) Investing

In the world of investing, there are many different styles to consider, but Growth at a Reasonable Price (GARP) is one strategy that strikes a balance between two commonly pursued paths: growth investing and value investing. GARP investing aims to harness the upside potential of growth while mitigating some of the risks associated with overpaying for that growth. It’s a compelling hybrid approach that can help investors navigate the complex dynamics of the market. Let’s explore what GARP is, how it works, and why it appeals to many savvy investors.

What Is GARP?

GARP, or Growth at a Reasonable Price, is an investment strategy that seeks to identify stocks with consistent earnings growth potential, without overpaying for them. It blends the attributes of both growth and value investing, meaning it aims for stocks that are growing faster than the average market rate but are not overly expensive compared to their future potential.

Peter Lynch, one of the most famous GARP investors, popularized this strategy in the 1980s while managing the Magellan Fund at Fidelity. Lynch emphasized investing in companies that demonstrated solid growth prospects but whose stock prices were not excessively high relative to their earnings—in other words, finding that “sweet spot” between growth potential and affordability.

Key Metrics for GARP Investing

To implement a GARP strategy, investors typically focus on specific metrics that can help gauge whether a stock represents a good balance between growth and price:

1. Price-to-Earnings Growth (PEG) Ratio: The PEG ratio is the hallmark metric of GARP investors. It divides the price-to-earnings (P/E) ratio by the company’s projected earnings growth rate. A PEG ratio of 1 or below is often viewed as an attractive target for GARP investors, as it indicates that the stock’s valuation is in line with or better than its growth prospects.

2. Earnings Per Share (EPS) Growth: GARP investors look for companies with consistent EPS growth, usually in the range of 10% to 20% annually. This indicates that the company is expanding steadily, but not at an unsustainable or overly speculative pace.

3. Reasonable Valuation Metrics: While GARP investors are willing to pay for growth, they avoid excessive valuations. This means they often seek stocks with a moderate P/E ratio compared to the broader market or industry peers.

The Appeal of GARP

The GARP strategy appeals to investors who want a balance between high-risk growth stocks and safer, undervalued opportunities. Growth investors may chase companies with meteoric potential but run the risk of overvaluation or speculative bubbles. On the other hand, value investors might miss out on high-quality companies that are steadily expanding. GARP investors strive for the best of both worlds: they want to capture growth opportunities while ensuring they don’t overpay.

The ability to find growth-oriented stocks at reasonable prices provides a way for investors to grow their portfolios while minimizing risk.

Benefits and Challenges of GARP Investing

Benefits:

- Risk Mitigation: By focusing on reasonably priced growth, GARP investors reduce the risk of buying into overhyped stocks that may be overvalued.

- Sustainable Growth: GARP stocks are typically companies with solid business fundamentals that offer consistent and sustainable growth.

- Diversification: GARP investors often build diversified portfolios that include companies from a range of sectors, reducing concentration risk.

Challenges:

- Finding the Balance: The core challenge of GARP is finding stocks that fit both growth and value criteria. In heated markets, it can be difficult to locate growth stocks that are reasonably priced.

- Subjectivity of Valuation: The term “reasonable price” can be subjective. Investors may have differing views on what constitutes an attractive PEG ratio or P/E multiple, leading to potential discrepancies in stock selection.

Is GARP Right for You?

GARP investing is suitable for those who want a balanced approach that minimizes risk while capturing growth. It’s a less aggressive strategy compared to pure growth investing, making it a good fit for moderate risk-takers who still want exposure to expanding industries and companies.

However, GARP requires patience and a disciplined approach to valuation. It involves a deep understanding of the financial health of companies and a keen eye for evaluating the fairness of current stock prices relative to future potential.

Conclusion

Growth at a Reasonable Price (GARP) provides a balanced, measured approach to investing by blending elements of both growth and value strategies. It’s ideal for investors who wish to enjoy the benefits of growth without the pitfalls of overpaying. By focusing on reasonable valuations and sustainable growth metrics, GARP investors can achieve solid, long-term portfolio growth while reducing the risk of investing in overpriced assets.

If you’re someone looking to navigate the middle ground between growth and value, GARP might be the strategy that helps you build wealth while keeping risk in check.

Peter Lynch's Investing Principles

The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them. Stand by your stocks as long as the fundamental story of the company hasn’t changed.

Owning stocks is like having children – don’t get involved with more than you can handle.

Know what you own, and know why you own it.

In stocks as in romance, ease of divorce is not a sound basis for commitment.

When you sell in desperation, you always sell cheap.

With every company, there is something to worry about, but the question is, which worries are valid and which are not?

Remember, things are never clear until it’s too late.

Whenever you invest in any company, you’re looking for its market cap to rise. This can’t happen unless buyers are paying higher prices for the shares, making your investment more valuable.

Never fall in love with a stock; always have an open mind

There’s no such thing as a worry-free investment. The trick is to separate the valid worries from the idle worries, and then check the worries against the facts.

Your investor’s edge is not something you get from Wall Street experts. It’s something you already have.

If you can follow only one bit of data, follow the earnings—assuming the company in question has earnings.

Behind every stock is a company. Find out what it’s doing.

Big companies have small moves, small companies have big moves.

There’s no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or worse, to buy more of it when the fundamentals are deteriorating.

Never invest in any company before you’ve done the homework on the company’s earnings prospects, financial condition, competitive position, etc.

All else being equal, invest in the company with the fewest color photographs in the annual report.

Go for a business that any idiot can run – because sooner or later any idiot probably is going to be running it.

If it’s a choice between investing in a good company in a great industry, or a great company in a lousy industry, I’ll take the great company in the lousy industry any day.

"One Up on Wall Street" by Peter Lynch

Peter Lynch, the legendary manager of the Fidelity Magellan Fund 🏦, is widely recognized as one of the most successful investors 📊 of all time. His book, One Up on Wall Street, has become a must-read for both novice and experienced investors since its publication in 1989. Despite being decades old, the book’s wisdom is as relevant today as it was back then. Lynch’s approach to investing, which combines common sense with a deep understanding of companies, offers timeless guidance. Let’s dive into some of the key insights that make One Up on Wall Street a timeless investment playbook that continues to resonate with investors across generations.

The Power of Individual Investors 💪

One of Lynch’s core messages is that individual investors have significant advantages over Wall Street professionals. He argues that everyday people can leverage their unique experiences and insights to identify great investments before institutional investors catch on. By simply observing the world around them—paying attention to trends, new products, and customer preferences—individuals can discover potential growth stocks early on.

Lynch famously states, “Invest in what you know.” He encourages investors to take advantage of their specialized knowledge, be it as consumers, employees, or even hobbyists. By investing in companies whose products they understand and believe in, investors are more likely to make informed decisions and ride the wave of growth. Lynch’s philosophy is built on the idea that individual investors can find opportunities in their day-to-day lives that professionals may overlook. This approach democratizes investing, making it accessible to anyone willing to pay attention and do the necessary research.

Lynch also highlights the importance of being patient and disciplined. Unlike professional fund managers who may be under pressure to deliver short-term results, individual investors have the flexibility to hold onto stocks for the long term. This allows them to benefit from the compounding growth of well-chosen investments. Lynch’s perspective empowers individuals by showing them that successful investing is not about having access to insider information or complex financial models, but about recognizing potential and staying the course.

The Six Categories of Stocks 📊

To help investors understand the different types of companies they might consider, Lynch classifies stocks into six categories: Slow Growers, Stalwarts, Fast Growers, Cyclicals, Turnarounds, and Asset Plays. Each category has distinct characteristics, and understanding them helps investors create a diversified and balanced portfolio. For example:

· Slow Growers are mature companies with modest growth rates, often paying high dividends. These companies may not offer significant capital appreciation, but they provide stability and consistent income, making them suitable for conservative investors.

· Stalwarts are established companies with steady, reliable growth. These companies may not grow as quickly as Fast Growers, but they provide a balance of growth and stability, making them a solid choice for risk-averse investors.

· Fast Growers are smaller companies expanding rapidly, offering high reward potential but also higher risk. These stocks can generate substantial returns, but investors need to be vigilant and willing to accept volatility.

· Cyclicals are companies whose performance is closely tied to the economic cycle. They tend to do well during economic expansions but may struggle during recessions. Understanding the economic cycle is key to successfully investing in cyclicals.

· Turnarounds are companies in trouble but with the potential for recovery, presenting opportunities for significant gains if they manage to turn the tide. These stocks are risky but can be highly rewarding for investors who can identify a true turnaround story.

· Asset Plays are companies with valuable assets that may not be fully reflected in their stock price. These assets could be anything from real estate to patents or even valuable inventory.

Understanding these categories helps investors tailor their strategies to their own risk tolerance and financial goals. By categorizing stocks, Lynch provides a framework that helps investors think more critically about the different opportunities available in the market. This approach also aids in building a diversified portfolio that balances risk and reward across different types of investments.

The Importance of Doing Your Homework 📚

Lynch emphasizes the importance of doing thorough research before investing. He believes that a well-informed investor can significantly improve their odds of success. In One Up on Wall Street, Lynch offers a practical framework for analyzing companies, covering everything from understanding a company’s financials to assessing its competitive advantages and future prospects.

His advice is simple but effective: understand the story behind the company. If you can’t explain why a company is a good investment in a few sentences, then you probably don’t understand it well enough to invest in it. Lynch uses the term “story” to refer to the rationale behind a company’s growth potential, which could be anything from a new product line to market expansion or an industry turnaround. He encourages investors to look beyond the numbers and understand the qualitative aspects of a business, such as its management, industry position, and the strength of its products or services.

Lynch also advises investors to be wary of companies that are too complex or difficult to understand. If a company’s business model or financials are overly complicated, it may be a sign that the investment is too risky. Instead, he advocates for simplicity and clarity—investing in businesses that are easy to understand and that have a clear path to growth. By focusing on the fundamentals and doing their homework, investors can make more informed decisions and avoid common pitfalls.

Ignore the Noise and Focus on the Long Term ⏳

One of the most critical lessons from Lynch is to ignore market volatility and the constant barrage of news. He believes that the stock market’s short-term movements are unpredictable, and trying to time the market often leads to poor results. Instead, Lynch advises investors to focus on the fundamentals and maintain a long-term perspective.

He famously said, “The real key to making money in stocks is not to get scared out of them.” By sticking with companies that have strong fundamentals and growth potential, investors can take advantage of the power of compounding and ride out the inevitable ups and downs of the market. Lynch’s emphasis on the long term is a reminder that the real value of investing comes from holding quality stocks for extended periods, allowing the business to grow and the investment to appreciate.

Lynch also cautions against being swayed by market sentiment or trying to predict macroeconomic events. He believes that individual companies’ performance is what ultimately drives stock prices, and investors should focus on finding good businesses rather than worrying about short-term market movements. By keeping a long-term outlook and ignoring the noise, investors can stay calm during market downturns and avoid making rash decisions that could harm their portfolios.

The Bottom Line ➡️

One Up on Wall Street is a practical and insightful guide for investors looking to improve their understanding of the stock market. Peter Lynch’s emphasis on using common sense, doing your homework, and maintaining a long-term perspective provides valuable lessons that resonate across generations of investors. His belief in the power of individual investors and their ability to “one-up” Wall Street professionals by investing in what they know remains a powerful reminder that successful investing doesn’t have to be complicated.

If you’re interested in a straightforward approach to investing that empowers you to leverage your unique experiences, One Up on Wall Street is a must-read. Lynch’s timeless wisdom can help you navigate the often-complex world of investing with confidence and clarity. By focusing on what you know, doing thorough research, and maintaining patience, you can achieve success in the stock market just as Lynch did. His insights remind us that successful investing is within reach for anyone willing to put in the effort and stay committed for the long haul.

Best Quotes from One Up on Wall Street 📝

1. “Know what you own, and know why you own it.”

2. “The real key to making money in stocks is not to get scared out of them.”

3. “Invest in what you know.”

4. “In the stock market, the most important organ is the stomach. It’s not the brain.”

5. “Behind every stock is a company. Find out what it’s doing.”

6. “The simpler it is, the better I like it.”

7. “Everyone has the brainpower to follow the stock market. If you made it through fifth-grade math, you can do it.”

8. “You have to keep your priorities straight if you plan to do well in stocks.”

9. “Time is on your side when you own shares of superior companies.”

10. “There’s no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or worse, to buy more of it, when the fundamentals are deteriorating.”

"Beating The Street" by Peter Lynch

Peter Lynch, one of the most successful mutual fund managers of all time, shared his insights on how to beat the market in his classic book Beating the Street. Lynch, who managed the Fidelity Magellan Fund and achieved an average annual return of 29% during his tenure, presents a hands-on guide that provides a deeper understanding of how he achieved such success. Lynch’s engaging and practical advice makes Beating the Street a must-read for those interested in making informed investment decisions and achieving long-term financial success.

The Fidelity Magellan Fund Story 🚀

Beating the Street begins with Lynch recounting his experience managing the Fidelity Magellan Fund. He transformed it from a relatively small fund into the world’s largest and most successful mutual fund during his tenure. This story serves as a practical illustration of Lynch’s investment principles in action. He highlights the importance of having a solid process, discipline, and a deep understanding of the companies one invests in. Lynch explains that by focusing on the fundamentals and being adaptable, he was able to achieve outstanding returns.

Lynch also emphasizes that the key to managing a successful fund is to stay diversified. He famously managed a portfolio of hundreds of stocks, and he likened his investment strategy to owning a garden: some plants grow fast, others need time, and some inevitably wither. By maintaining a diverse portfolio, Lynch was able to protect against losses and take advantage of numerous opportunities, regardless of market conditions.

How to Pick Winning Stocks 🏆

In Beating the Street, Lynch outlines a systematic approach to picking winning stocks. He believes that individual investors can achieve outstanding returns if they put in the effort to research companies thoroughly. Lynch stresses the importance of understanding what a company does, how it makes money, and why it has a competitive edge. He urges investors to consider factors such as the company’s industry, management quality, and growth prospects.

Lynch introduces his “Twelve Silliest (and Most Dangerous) Things People Say About Stock Prices” to help investors avoid common pitfalls. For example, he warns against relying on macroeconomic predictions, as they often have little bearing on individual companies’ performances. Instead, Lynch encourages focusing on the fundamentals of the business.

Lynch also uses a technique he calls “the two-minute drill,” which challenges investors to be able to explain why they own a particular stock in just two minutes. If you can’t easily articulate why the company is a good investment, then you probably haven’t done enough homework. This simple yet powerful exercise forces investors to focus on the essential reasons why a stock is worth buying.

The Importance of Finding the Right Story 📖

Peter Lynch believes that every successful investment starts with a compelling story. He encourages investors to look for companies that have a “story” that suggests why they are poised for growth. This story could involve a new product, a significant expansion, or a turnaround situation. Lynch explains that finding the right story is crucial because it keeps investors focused on the long-term potential of the company, even when the market gets volatile.

He also emphasizes the need to understand what could go wrong with the story. Being realistic about the risks allows investors to make better-informed decisions and avoid overconfidence. Lynch’s approach to finding the story behind each company makes investing accessible, even for those who do not have a background in finance. He believes that with curiosity and common sense, investors can identify the stories that make for great investments.

Why Individual Investors Have an Edge 💪

Lynch is a big advocate of the idea that individual investors have an edge over institutional investors. He believes that everyday people can capitalize on opportunities faster than large funds, which have bureaucratic constraints and require significant time to build or exit large positions. Individual investors, on the other hand, can be more agile and invest in small-cap stocks or lesser-known opportunities that might be too small for large funds to consider.

He also highlights that individual investors are closer to everyday products and services. By simply paying attention to the products they use, their kids love, or their local community prefers, they can get ahead of Wall Street in identifying promising investments. Lynch tells readers that some of his best investment ideas came from observing companies around him—places he shopped, restaurants he ate at, and brands his family loved.

Staying the Course During Market Fluctuations 📈📉

One of the key messages Lynch delivers in Beating the Street is the importance of staying the course, even during market downturns. He reminds investors that the market’s short-term volatility is unavoidable but should not dictate long-term investment decisions. Lynch’s confidence in the resilience of good businesses helps investors maintain a long-term perspective, which is essential for benefiting from the power of compounding.

Lynch is also critical of trying to time the market, as he believes that no one can predict with certainty when the market will rise or fall. Instead, Lynch encourages investors to focus on buying good companies at reasonable prices and holding them for the long term. The key is to ignore short-term fluctuations and to trust in the fundamentals of the companies that have strong growth potential.

The Bottom Line ➡️

Beating the Street is an essential read for anyone looking to take control of their investments and understand how to pick winning stocks. Peter Lynch’s practical advice, emphasis on common sense, and focus on the fundamentals provide a straightforward approach to achieving financial success. His belief in the power of individual investors and their ability to outperform professionals is inspiring and empowering. Lynch provides readers with the tools they need to invest wisely and avoid common mistakes, making Beating the Street a timeless resource for investors of all levels.

If you’re looking for a guide that teaches you how to analyze companies, find compelling stories, and stay committed to your investments, Beating the Street is a must-read. Lynch’s insights are invaluable for anyone seeking to build a strong portfolio and master the art of investing.

Best Quotes from Beating the Street 📝

1. “The person that turns over the most rocks wins the game. And that’s always been my philosophy.“

2. “This is one of the keys to successful investing: focus on the companies, not on the stocks.“

3. “In dieting and in stocks, it is the gut and not the head that determines the results.“

4. “The stock market really isn’t a gamble, as long as you pick good companies that you think will do well, and not just because of the stock price.“

5. “When you invest in the stock market you should always diversify.“

6. “Never fall in love with a stock; always have an open mind.“

7. “You should not buy a stock because it’s cheap but because you know a lot about it.“

Peter Lynch's Investing Principles: Timeless Strategies for Successful Investing 📈💡

Magellan Fund, has provided invaluable guidance to individual investors through his books and teachings. Lynch’s investing principles emphasize simplicity, common sense, and in-depth research. Let’s explore some of the key investing principles that have made Peter Lynch one of the most respected names in the world of investing.

1. Invest in What You Know 🏠💼

One of Peter Lynch’s most famous principles is to “invest in what you know.” He encourages individual investors to look for opportunities in their everyday lives. Lynch believes that investors can identify great companies simply by observing the products they use and the services they love. By investing in businesses that are familiar, investors have an edge, as they are more likely to understand the company’s operations, products, and market.

For Lynch, knowledge about a company’s product or service can be a key factor in determining whether it is a good investment. For example, if a new product is gaining popularity, that could indicate the potential for the company’s growth. The idea is to leverage everyday experiences to spot emerging trends before they are widely recognized by Wall Street.

2. Do Your Homework 📚🔍

Lynch emphasizes the importance of doing thorough research before investing in any stock. He believes that successful investing requires a deep understanding of a company’s fundamentals, including its financials, competitive advantage, and growth prospects. Lynch’s approach involves reading financial statements, understanding the industry, and identifying the factors that could drive the company’s growth.

He is also a big advocate of the “story” behind a stock. Lynch encourages investors to be able to articulate why a company is a good investment in a few sentences. If you can’t explain the story behind a company’s potential success, then you probably don’t know enough to invest in it. This focus on understanding a company’s narrative helps investors make well-informed decisions.

3. Categorize Your Stocks 📊🗂️

Lynch believes that every stock falls into one of six categories: Slow Growers, Stalwarts, Fast Growers, Cyclicals, Turnarounds, and Asset Plays. By categorizing stocks, investors can better understand the risk and return potential of each investment. Each category has its own characteristics and requires a different approach:

· Slow Growers are mature companies with modest growth but often pay reliable dividends.

· Stalwarts are companies with steady, consistent growth. They may not have explosive potential, but they offer stability.

· Fast Growers are smaller, rapidly expanding companies with the potential for substantial gains.

· Cyclicals are companies whose performance is tied to the economic cycle, which means they can be highly profitable during booms but face challenges during recessions.

· Turnarounds are struggling companies with the potential to recover and provide significant returns.

· Asset Plays are companies with valuable assets that may not be fully reflected in their current stock price.

By categorizing investments, Lynch helps investors think critically about the potential risks and rewards associated with each stock and how it fits into their overall portfolio strategy.

4. Avoid Market Timing ⏳🚫

Lynch strongly discourages trying to time the market, as it is notoriously unpredictable. He believes that instead of attempting to predict market highs and lows, investors should focus on finding fundamentally strong companies and holding them for the long term. Market volatility is a part of investing, and Lynch’s advice is to stay the course and not be swayed by short-term market movements.

He famously said, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” By staying focused on the long-term growth potential of good companies, investors can avoid the pitfalls of trying to time the market.

5. The Power of Patience 🕰️💸

Patience is a crucial element of Peter Lynch’s investing philosophy. He believes that successful investing requires a long-term perspective and that compounding is the key to building wealth. Lynch advises investors to hold onto their investments as long as the fundamentals of the company remain strong. By allowing investments time to grow, investors can take advantage of compounding returns, which can lead to substantial wealth over time.

Lynch also emphasizes the importance of not getting scared out of investments during market downturns. Short-term fluctuations are normal, but selling out of fear can lead to missed opportunities. By maintaining confidence in the companies you invest in, and by holding for the long term, you are more likely to achieve significant gains.

6. Know When to Sell 🛑📉

Knowing when to sell a stock is just as important as knowing when to buy. Lynch advises that investors should sell a stock when the reasons they initially bought it no longer apply. If the company’s fundamentals deteriorate, its growth prospects falter, or if the original story changes, it may be time to move on. Lynch also warns against holding onto stocks simply because of emotional attachment or because you want to break even.

On the other hand, if the company’s story remains strong and it continues to perform well, there is no reason to sell, even if the stock price has already increased significantly. Lynch believes in letting winners run, as long as the underlying fundamentals support continued growth.

7. Diversify, But Not Too Much 🌱🔄

Lynch advocates for diversification to manage risk, but he warns against over-diversification. He believes that owning too many stocks can make it difficult to keep track of individual companies, which can dilute an investor’s ability to make informed decisions. Instead, Lynch suggests owning a manageable number of stocks that you can thoroughly research and understand.

By focusing on a smaller number of well-researched stocks, investors can increase their chances of achieving outsized returns. Lynch himself managed hundreds of stocks in the Magellan Fund, but he advises individual investors to focus on what they can realistically handle.

8. Trust Your Gut and Use Common Sense 🤔🧠

Peter Lynch often speaks about the importance of trusting your own instincts when investing. He encourages investors to rely on their own observations, knowledge, and experiences rather than solely following analysts or financial experts. Lynch believes that common sense is an invaluable tool in investing, and everyday experiences can often provide valuable insights into which companies are poised for growth.

He also advises against investing in companies or industries you do not understand. Lynch’s straightforward approach is about sticking with what makes sense and avoiding overly complex or opaque investments.

The Bottom Line ➡️

Peter Lynch’s investing principles are rooted in simplicity, patience, and a deep understanding of the companies in which you invest. By investing in what you know, doing your homework, categorizing your stocks, and maintaining a long-term perspective, Lynch believes that individual investors can achieve exceptional results. His approach is empowering because it shows that successful investing is within reach for anyone willing to put in the effort to understand their investments.

If you are looking for practical, straightforward advice on how to build a successful investment portfolio, Peter Lynch’s investing principles provide an excellent foundation. His emphasis on common sense, patience, and thorough research remains as relevant today as ever, making Lynch’s teachings a timeless resource for investors at all levels.