MICHAEL BURRY

Michael J. Burry is an American investor and hedge fund manager, best known for predicting and profiting from the 2008 financial crisis. He founded Scion Capital, which he ran from 2000 to 2008. Burry’s contrarian approach and analytical rigor have earned him recognition in finance.

Born in San Jose, California, Burry lost his left eye to retinoblastoma at age two. He studied economics and pre-med at UCLA, earned an MD from Vanderbilt University, and began but did not complete a residency at Stanford.

Burry gained prominence by successfully shorting subprime mortgages, as chronicled in Michael Lewis’s “The Big Short.”

Michael Burry's Biography, Net Worth, Personal Life, Investing Style and Interesting Facts

1971

Michael Burry was born on June 19, 1971 in San Jose, California, United Statesa

1990

Graduates from the University of California, Los Angeles (UCLA) with a Bachelor’s degree.

In fact, my time as an undergraduate at UCLA was a seemingly random walk through Economics, English, and Biochemistry, without even one course in accounting.

Michael Burry

1997

Completes his medical degree from Vanderbilt University School of Medicine and obtains a physician’s license.

1997-2000

Continues his medical education as a resident at Stanford University Hospital before leaving after his third residency year to start Scion Capital.

2000

Takes the entrepreneurial leap by establishing Scion Capital, his own hedge fund, where he initially funds the venture with contributions from both himself and his family (His mother contributed $20,000 and his three brothers $10,000 each).

2000

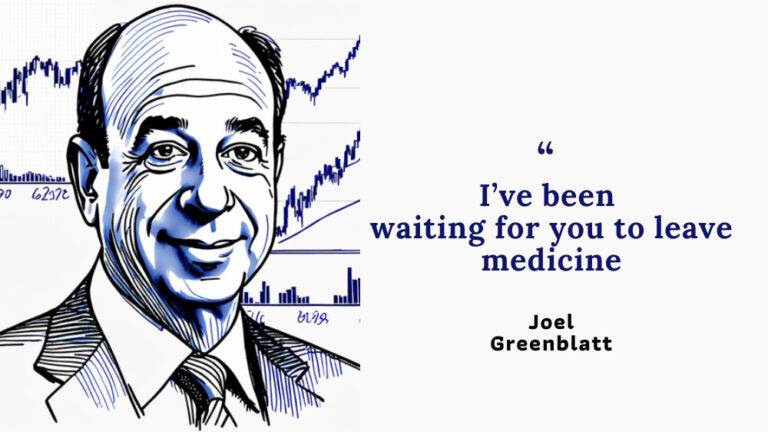

Michael Burry’s first investors become Joel Greenblatt – founder of Gotham Capital ($1,000,000) and Jack Byrne from White Mountains ($600,000).

I left medicine on June 30, 2000 to develop Scion Capital, LLC. I was fortunate to catch the interest of Joel Greenblatt, the legendary value manager who headed the Gotham Capital hedge fund. In short order, both Gotham Capital and White Mountains Insurance Group (NYSE: WTM) acquired portions of Scion Capital.

I expect to run Scion Capital for a long, long time, and I will always hold one goal dearest. That is, to be conservative yet creative in the successful allocation of capital for maximum return.

– Michael Burry

2004

By the end of 2004, Michael Burry was managing $600 million.

2005

Recognizes early signs of trouble in the subprime mortgage market and strategically invests in credit default swaps (CDS) on subprime mortgage bonds, effectively betting against the housing market.

2007

Burry’s accurate predictions came true when the subprime mortgage market collapsed, causing a global financial crisis. He not only saved his investors from losses, but he also made a significant profit for himself and his backers. He earned $100 million personally and $725 million for his investors.

2008

Decides to close Scion Capital, returning the remaining funds to his investors marking the end of en era.

2010

The book “The Big Short” made Michael Burry famous. It told the story of how he bet against the subprime mortgage market and made a fortune when it collapsed. The book was a critical and commercial success and it turned Burry into a household name.

2010

Initiates a fresh chapter in his career by establishing Scion Asset Management, primarily managing his personal investments through this entity.

2013

Expresses concerns about the potential bubble in passive index funds, cautioning that they may distort the market and increase systemic risk.

2015

The Big Short film directed by Adam McKay and written by McKay and Charles Randolph, based on Michael Lewis’s 2010 book The Big Short: Inside the Doomsday Machine is released telling the story of Michael Burry and other investors who bet against the subprime mortgage market in the lead-up to the 2007 financial crisis.

2019

Burry gains attention for his significant long position in GameStop, a struggling video game retailer. This position takes center stage when the WallStreetBets subreddit community rallies behind the stock 2021, leading to a massive short squeeze.

2021

He Continues to captivate the financial world with his cautionary views on speculative excess and market risks. He actively shares his insights and analysis through his X (Formerly Twitter) account, amassing a substantial following.

2022-2023

Burry Issues warnings about inflation and the potential for an impending recession, maintaining his reputation as a prominent financial seer.

PERSONAL LIFE

Michael Burry was married twice. His first wife was a Korean descent and his second wife to whom he is still married is a Vietnamese- American. Michael Burry and his family live in Saratoga, California. His son was diagnosed with Asperger syndrome, and after learning more about the disorder Burry believes he also has it.

NET WORTH

Michael Burry’s estimated net worth is around $300 million.

Burry became millionaire at the age of 29, when he sold part of his Scion Capital hedge fund to investors.

Michael Burry is NOT in Forbes World Billionaires list or in Bloomberg Billionaires Index.

INVESTING STYLE

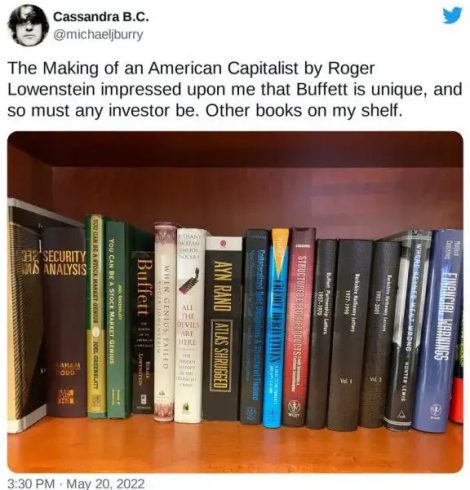

Burry’s investment approach draws heavily from the principles outlined in Benjamin Graham and David Dodd’s influential book “Security Analysis” published in 1934.

As my moniker implies, I’m a value investor. A pretty deep one. Yet while my influences are traditional, I’ve developed my own version of value investing. This version has been tuned empirically with a singular goal: maximize risk-adjusted returns – Michael Burry

INTERESTING FACTS

Burry was born with retinoblastoma, a rare form of cancer that caused him to lose his left eye at the age of two.

Michael believes he has Asperger’s syndrome, and has said that it allows him to see the world in a unique way.

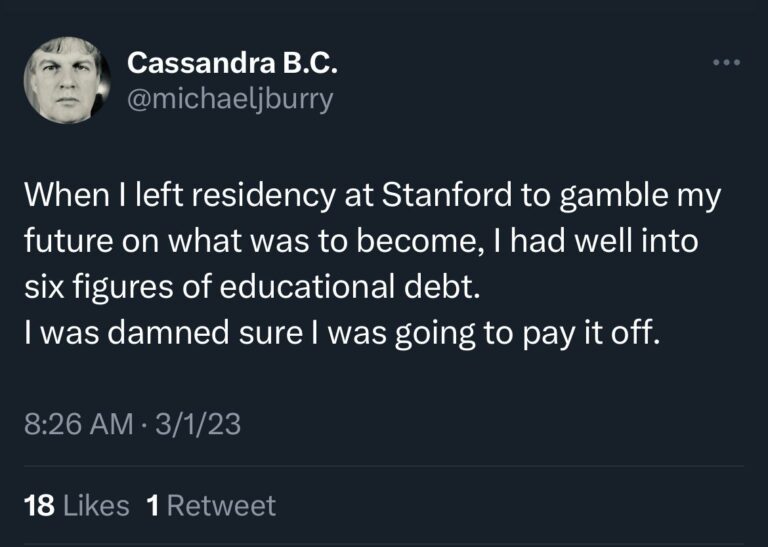

Burry has nicknamed himself in his X account Cassandra B. C. . In Greek mythology, Cassandra was a Trojan priestess granted the power to foresee the future but cursed so that no one would believe her predictions.

Burry is a fan of heavy metal music including bands such as DevilDriver, Entombed, Motionless in White, As I Lay Dying, Dismember, Obituary, Lamb of God and Amon Amarth.

In his Match.com profile, Burry described himself frankly as “a medical resident with only one eye, an awkward social manner, and $145,000 in student loans.”

The name Scion Capital was inspired by Terry Brooks’ novel “The Scions of Shannara”, one of Burry’s favorite books.

Michael Burry had successful finance website/blog (valuestocks.net) that won a Forbes “Best of the web” award for stock picking.

…ValueStocks.net site, which won nice reviews in Barron’s, in The San Francisco Chronicle, and on CNBC. (Twice, the site was chosen Best of the Web in stock picking by Forbes.) – Michael Burry

Michael Burry used to write articles on stocks for MSN Money in the early 2000s.

During early 1997, I created a finance web site that espoused rational valuation principles and practice amid a growing internet-related stock bubble. That led to a side career as a freelance financial journalist for sites like MSN Money. In time, even with my time constraints, I came to realize that I had researched the companies about 10 times more thoroughly than any of the analysts I interviewed. In fact, I came to view sell-side analysts and their bosses as often relatively simple when it comes to their investment conclusions. – Michael Burry

MICHAEL BURRY'S STORY: FOUNDING SCION CAPITAL

Key Takeaways

In 1996 while being a medical intern Burry started a blog where he posted his stock-market trades and his arguments for making the trades.

He quickly gained a following, and his blog became known as one of the most insightful and prescient investment blogs on the Internet.

In 2000, Michael Burry established his own hedge fund, Scion Capital and got his first investment ($1,000,000) from Joel Greenblatt (Gotham Capital) who was following his blog.

In 2005 he made a bet against the subprime mortgage market, which paid off handsomely (Burry made $100 million for himself and $ 725 million for his investors) when the market crashed in 2007-2008.

In 1996, Michael Burry was a medical intern on a cardiology rotation at Saint Thomas Hospital in Nashville, Tennessee. One night, he logged on to a hospital computer and went to a message board called techstocks.com. There he created a thread called “value investing”.

On August 26, 1998 Burry started running his own website valuestocks.net. On his blog, Burry posted his stock-market trades and his arguments for making the trades. He also wrote about his investment philosophy, which was based on the value investing principles of Benjamin Graham and Warren Buffett.

VALUESTOCKS.NET www.valuestocks.net

Supposedly for value investors, though Warren Buffett might not agree with this definition of value. Run by a 28-year-old neurology resident Dr. Michael Burry, Valuestocks.net showcases Burry’s own $50,000 portfolio, which includes some surprising choices including Pixar, the maker of Toy Story. Has good information on how to identify net-net stocks (trading for less than assets minus all conceivable liabilities). Accompanying all this are Burry’s incisive reports, as good as anything from Wall Street. One of the site’s best features is a list of essential finance texts, including thumbnail reviews and links to Amazon.com (Burry’s only source of revenue, since he doesn’t accept banner ads).

BEST: Original analysis, links to great finance sites, and a must-read book list for value investors.

WORST: Limited content is sometimes dated. – Forbes May 22, 2000

Burry’s blog quickly gained a following, and he soon became known as one of the most insightful and prescient investors on the Internet. In 2000, he established his own hedge fund, Scion Capital. The name Scion Capital was inspired by Terry Brooks ‘novel “The Scions of Shannara”, one of Burry’s favorite books. Burry initially funded Scion Capital with his own savings and contributions from his family (His mother contributed $ 20,000 and his three brothers $ 10,000 each). However, he soon attracted the attention of other investors, including Joel Greenblatt and Jack Byrne. Greenblatt was a value investing guru, and Byrne was a member of Warren Buffett’s inner circle. Both Greenblatt and Byrne were impressed with Burry’s investment acumen, and they offered to invest in Scion Capital. Burry accepted their investments, and Scion Capital was officially launched. In its early years, Scion Capital was a small hedge fund with just a few million dollars in assets. However, Burry’s investment performance was outstanding. He consistently generated returns that beat the market, and he quickly gained a reputation as a top-performing hedge fund manager.

In 2001, the S&P 500 index fell by 11.8% but Michael Burry’s hedge fund, Scion Capital, gained 55%. The following year, the S&P index fell again by 22.1%, but Scion Capital gained 16%. In 2013, the stock market finally turned around and rose by 28.69%, but Burry beat the market again, with returns of 50%. By the end of 2004, Michael Burry was managing $600 million in assets. In 2005, Burry began to focus on the subprime mortgage market. He believed that the market was unsustainable, and he started shorting mortgage-backed securities

” By mid-2005, I had so much confidence in my analysis that I staked my reputation on it. That is, I purchased credit default swaps — a type of insurance — on billions of dollars worth of both subprime mortgage-backed securities and the bonds of many of the financial companies that would be devastated when the real estate bubble burst.” -MICHAEL BURRY

When the housing market crashed in 2008, Burry’s bet against the subprime mortgage market paid off handsomely. Michael Burry made over $100 million for himself and $725 million for his investors. From November1, 2000 to June 30, 2008, the Scion Capital had impressive net 489.34% gain (the gross gain had been 726%)

HOW MICHAEL BURRY PREDICTED THE 2008 MORTGAGE CRISIS

2003

“I had begun to worry about the housing market back in 2003, when lenders first resurrected interest-only mortgages, loosening their credit standards to generate a greater volume of loans.”

– MICHAEL BURRY

2004

“Throughout 2004, I had watched as these mortgages were offered to more and more subprime borrowers — those with the weakest credit. The lenders generally then sold these risky loans to Wall Street to be packaged into mortgage-backed securities, thus passing along most of the risk.”

– MICHAEL BURRY

2004

“At the same time, I also watched how ratings agencies vouched for subprime mortgage-backed securities. To me, these agencies seemed not to be paying much attention.”

– MICHAEL BURRY

2005

“By mid-2005, I had so much confidence in my analysis that I staked my reputation on it. That is, I purchased credit default swaps — a type of insurance — on billions of dollars worth of both subprime mortgage-backed securities and the bonds of many of the financial companies that would be devastated when the real estate bubble burst.”

– MICHAEL BURRY

2005-2006

Back in 2005 and 2006, I argued as forcefully as I could, in letters to clients of my investment firm, Scion Capital, that the mortgage market would melt down in the second half of 2007, causing substantial damage to the economy. My prediction was based on my research into the residential mortgage market and mortgage-backed securities. After studying the regulatory filings related to those securities, I waited for the lenders to offer the most risky mortgages conceivable to the least qualified buyers. I knew that would mark the beginning of the end of the housing bubble; it would mean that prices had risen — with the expansion of easy mortgage lending — as high as they could go.

– MICHAEL BURRY

2007

“During 2007, under constant pressure from my investors, I liquidated most of our credit default swaps at a substantial profit.”

– MICHAEL BURRY

2008

“By early 2008, I feared the effects of government intervention and exited all our remaining credit default positions — by auctioning them to the many Wall Street banks that were themselves by then desperate to buy protection against default. This was well in advance of the government bailouts.”

– MICHAEL BURRY

MICHAEL BURRY'S BOOK RECOMMENDATIONS

MICHAEL BURRY AND GAMESTOP INC.

Michael Burry invested heavily in GameStop Corp. (GME) in mid 2019

He saw an opportunity for the struggling video game retailer to conduct a substantial share buyback, effectively reducing the number of outstanding shares and potentially squeezing the short sellers.

Burry sold his entire stake in GameStop during late 2020, missing out on the astounding rally that followed, driven by an army of retail investors on the WallStreetBets subreddit.

GameStop’s stock price soared to unimaginable heights, reaching a peak of $483 per share in January 2021, representing a surge of nearly 2,000% from his exit point.

The Reddit-fueled surge in GameStop’s share price reached a point where Burry’s maximum holding, at its peak, could have been worth over $1.5 billion.

Despite missing out on the huge gains that followed, Burry’s early exit could have still netted him millions.

MICHAEL BURRY vs. ELON MUSK and TESLA

December 2020: Michael Burry shorts Tesla stock.

January 2021: Tesla’s stock price reaches an all-time high. Burry tweets: “Well, my last Big Short got bigger and bigger and BIGGER too. Enjoy it while it lasts.

February 2021: Burry says that a 90% plunge in Tesla’s stock price wouldn’t send shockwaves through the stock market. He compares the hype around Tesla to the excitement during the dot-com and housing bubbles.

November 2021: Tesla’s stock price hits another record high. Burry tweets: “Can $TSLA fall 80, 90%?” He also points to Musk’s stock sales at the time as evidence that the Tesla CEO knows his company is overvalued. Musk responds by calling Burry a “broken clock.”

Q3 2021: Burry exits his short position on Tesla.

April 2022: Burry tweets: “The competition came for Netflix, just like the competition is coming for Tesla.”

September 2022: Burry tweets: “If I am tweeting this you can bet I am not short it. But I should be.”

October 2022: Tesla’s stock price is down 67% from its peak in November 2021.

MICHAEL BURRY vs. CRYPTO

Since 2020, Burry has warned that the rapid rise of Bitcoin and other digital assets mirrors the speculative excesses of the dot-com and housing markets.

In 2021, he raised concerns about the widespread adoption of crypto by companies with little expertise in the field, seeing this as a potential risk.

Despite publicly musing about shorting Bitcoin in 2022, Burry later clarified he wasn’t actively betting against it but maintained his belief that the market was in bubble. His criticism also extends to meme tokens like Shiba Inu, which he dismisses as examples of irrational speculation.

Overall, Burry’s cautious stance on crypto reflects his broader investment philosophy, emphasizing the dangers of speculative markets.

Sources:

EXCERPT APRIL 2010 ISSUE/ Betting on the Blind Side / by MICHAEL LEWIS /;

OP-ED CONTRIBUTOR / I Saw the Crisis Coming. Why Didn’t the Fed? /By Michael J. Burry/

https://news.vanderbilt.edu/2011/04/13/video-burry-cls/

http://econ.ucla.edu/news/burry%20bio-oct2011.pdf

https://research.secdatabase.com/CIK/1182422/Company-Name/SCION-CAPITAL-LLC

https://twitter.com/michaeljburry/

Lewis, M. (2011). The big short: inside the doomsday machine. New York, W.W. Norton.

https://who.is/whois/valuestocks.net

https://twitter.com/michaeljburry/

https://www.cnbc.com/2021/10/15/michael-burry-of-the-big-short-asked-about-shorting-crypto-days-before-bitcoin-hit-60000.html