Stoke Therapeutics Inc. (STOK) Stock Analysis

Introduction

Stoke Therapeutics, Inc. is an early-stage biopharmaceutical company that was established in 2014. They focus on developing medicines to treat the underlying causes of severe genetic diseases. Utilizing their proprietary technology known as Targeted Augmentation of Nuclear Gene Output (TANGO), Stoke Therapeutics crafts antisense oligonucleotides (ASOs). These ASOs are designed to selectively increase the output of proteins from genes, aiming to compensate for genetic defects.

Based in Bedford, Massachusetts, Stoke went public in 2019 and has since been working on expanding its influence in the biotech sector.

Their pipeline includes STK-001, which is in clinical testing for Dravet syndrome—a severe and progressive form of epilepsy. They’re also exploring treatments for autosomal dominant optic atrophy (ADOA), which is the most common inherited optic nerve disorder. Beyond these, Stoke has a keen interest in haploinsufficiencies and diseases affecting the central nervous system and the eye, with their approach having potential applications in various organs, tissues, and systems.

Fundamental Analysis

Revenue and Growth: STOK’s trailing twelve-month (ttm) revenue is $8.78M, but it has seen a decrease of 29.22% from the previous year, signaling potential challenges in their business operations or market conditions.

Net Income: The company’s net income is significantly negative at -$104.70M ttm, indicating that it is operating at a loss. This is a continuation of a trend seen over the past several years.

Earnings Per Share (EPS): The EPS of -$2.38 ttm reflects the company’s inability to generate profit, which is consistent with the net income.

Liquidity: The company has a strong liquidity position with a current ratio of 6.99 and significant cash holdings of $201.96M, suggesting that it can cover its short-term liabilities.

Cost Management:

The operating margin and profit margin are deeply negative at -1307.21% and -1192.47% respectively. This is an indication that the company’s expenses far exceed its gross profit.

Cash Flow: The free cash flow is negative at -$82.68M ttm, which may be a concern for investors looking for companies with strong cash flow to support operations and growth initiatives.

Valuation Metrics

Market Capitalization: STOK has a market cap of $290.25M, which is moderate for small-cap biotech companies.

Price Ratios: With no P/E or Forward P/E, as well as extremely high P/S ratios, traditional valuation metrics are challenging for STOK. This often occurs in biotech firms that have not yet become profitable.

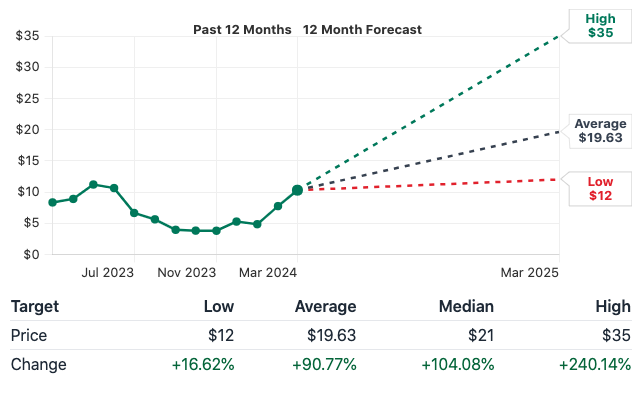

Price Target: Analysts have set a strong buy rating with a price target of $19.63, which represents a potential upside of 90.77%. This could be based on future drug pipeline prospects or strategic partnerships.

Stock Performance

Volatility: The beta of 0.67 indicates that the stock is less volatile than the market. However, this lower volatility doesn’t necessarily mean lower risk given the company’s financial position.

Price Movement: The stock has increased by 28.95% over the last 52 weeks, which may indicate investor optimism or reaction to specific events like clinical trial results or strategic partnerships.

Ownership and Analysts

Insider and Institutional Ownership: High institutional ownership at 98.84% could suggest confidence from large investors, while 5.24% insider ownership indicates that company insiders have a stake in the company’s success.

Operational Efficiency

Research and Development: Heavy investment in R&D is typical for biotech companies. STOK is no exception, with a significant proportion of its expenses in R&D, indicating a focus on developing its product pipeline.

Employee Metrics: Revenue per employee stands at $75,043 against profits per employee at -$894,863, which reflects high efficiency in revenue generation per employee but also significant losses per employee due to the overall net income.

Conclusion and Strategy Considerations

STOK’s financials reflect a common pattern in the biotechnology sector, where companies undergo prolonged periods of research and development before achieving profitability. The company’s significant cash reserves and lack of debt are positives, suggesting it can sustain operations without immediate need for additional financing. However, the persistent losses and negative cash flows highlight the risks involved.

Investors considering STOK will need to focus on the company’s potential for future earnings, which may be based on its pipeline of products, intellectual property, and the potential success of any drugs that are in development or awaiting regulatory approval.

A potential investment strategy would involve a detailed understanding of STOK’s drug pipeline, the addressable market for its treatments, and the likelihood of regulatory success. Biotech investments often carry high risk/high reward profiles and require a tolerance for volatility and the potential for total loss. Therefore, STOK may be better suited as a speculative part of a diversified portfolio rather than a core holding.

Finally, it’s essential for investors to stay informed about the company’s developments, particularly any progress in clinical trials or partnerships that can significantly impact the stock’s value.